House Hot Potato: Time to Sell Your Busy Road Home

Do you ever remember playing hot potato when you were a kid? You know, you get in a circle with friends and pass the symbolic “hot potato” around while music plays. The person who ends up with the potato when the music stops ends up “losing” and is out of the game. As less and less people are in the game, or the music speeds up, the pace gets a bit more frantic of passing, but ultimately, you don’t want to get stuck with the potato.

A few years back, I came up with the idea of house hot potato as I listed a friend and clients home. We had set out to purchase a home in an aggressive market (2016), similar to our current market, that highly favored sellers. We were constantly being outbid by other buyers on homes, and when a home came on the market in an amazing neighborhood, with some great characteristics, we jumped on it and put in an aggressive offer. At the time, we had to do all of the things that are happening now: increased purchase price, “as-is” inspection, guaranteeing appraisals, quick closings. My clients beat out 4 other offers, including a cash offer, and secured the home. Only rub…..it backed to a busy road. Enter house hot potato.

This Warren Shores home in central Fort Collins is beautiful, but ended up being a house hot potato because of road noise.

Fast forward a few years later (2019 to be exact) and life changes for my clients dictated that they would be moving out of state for a new job opportunity. As we entered the market, it became evident that the market we were selling in was not the same as the market we purchased in. Because interest rates were higher, the demand in the market had slowed down and subsequently, the frequency of multiple offers was not as prevalent. While their home was located in a highly desirable neighborhood of Warren Shores, and our marketing brought dozens of showings in the first weekend, we struggled to get anyone to bite on the home. It seems that the road noise from Horsetooth was just too much for more discerning buyers to bear, and the lack of the ability to fence in a yard ruled out many other buyers. We ended up sitting on the market much longer than expected, and after losing all listing momentum, we were forced to lower our price and expectations in the market. The end result, we did get an offer well below where we expected, and ended up having many costly inspection issues that we had to address for the buyers to get the home closed. Just another year later, as interest rates decreased, the potato would have passed to another buyer at a premium price.

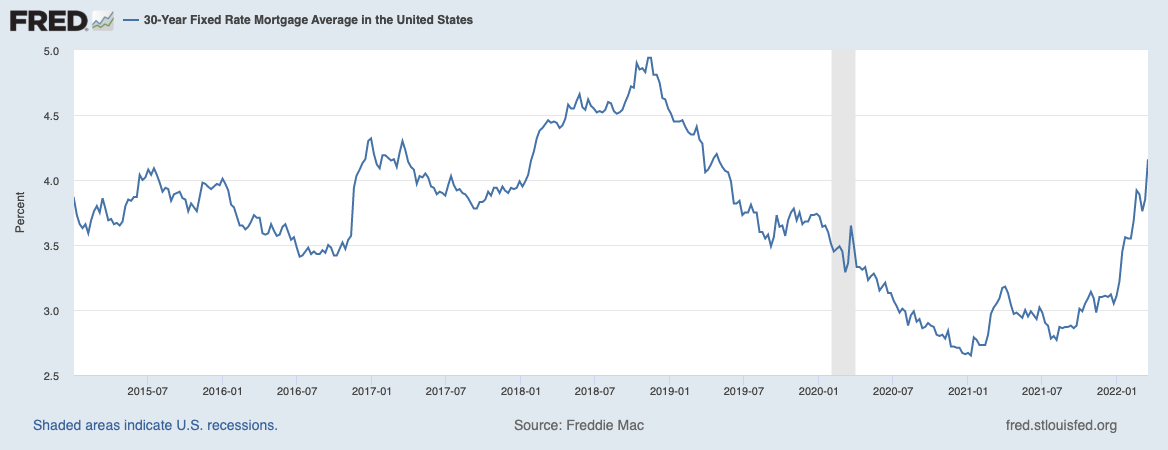

Notice the peak interest rate of 5.0% in 2019. We are currently climbing back towards that peak which will decrease demand

2019 had some of the lowest year over year appreciation in the past cycle as the interest rate was higher than previous years

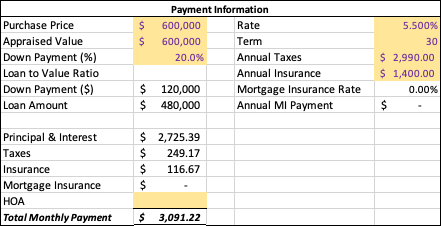

Here is an example of a $600,000 home purchase with 20% down at 5.5% interest rate. Rental rates above $3000 are not very common in most homes….yet

I see some similarities in our current market to the market that one in the past. The interest rate in 2019 climbed all the way up to 5% (which is still historically low) which curbed a bit of the demand in the market and decelerated the appreciation. More importantly though, the deceleration first affected properties that can be tougher to sell, specifically ones in not as ideal neighborhoods and homes that backed to busy roads, etc. This year, we are struggling with the lowest supply that we have ever seen in Fort Collins. The lack of supply will help buffer that major swing in momentum, but at the same time, you cannot turn away from the fact that interest rates are increasing at some somewhat alarming rates (We’ve gone from the low 3%’s to the mid 4%’s in just 3 months in 2022). Perhaps even more importantly, many homes that back or front too busy roads may have traditionally been considered good rental properties as renters tend to not care as much about noise, etc. However, because we appreciated almost 18% last year, purchasing a rental that cash-flows has become tighter. Furthermore, the increasing interest rate, especially for investments, may push borrowing power into territory that just doesn’t make sense for many investors as they cannot rent the homes they buy for enough to cover their mortgage costs.

So what does this mean? If you own a property on a busy road (Shields, Mulberry, Prospect, Taft Hill, and to a lesser extent Laporte Ave) you may want to look into your options of selling as times may get tougher to sell in the next 6 months. The increased interest rate is going to slow the boat down a bit, but it will be the house hot potatoes that get hit first. Ultimately, if you don’t know if you own a house hot potato, give me a call, I’ll let you know if you should be playing the game and I can certainly help you develop a plan that best suits your living needs!