March 25’ - Listing Spotlight

Last year I described March activity as “Slow, slow, slow”. Turns out 2025 wasn’t much busier as only 9 properties became available this past month. Within that inventory, many were condo’s that don’t necessarily have quite the draw that single family inventory has. In fact, only 2 of the 9 homes listed were single family homes (there were a few duplexes listed and condos as well). Both of the single family homes were under contract in quick fashion. So what does that mean for the coming month(s)? From what I see, despite overall demand in the market being somewhat down (due to affordability from interest rates) there still is demand in Old Town for mid-range priced ($500-$800K) single family homes….especially those with at least 3 bedrooms. 2 bedroom homes with some flex space also fit the bill, provided that they are priced in a manner that isn’t egregious. I would expect to see more inventory hit the market in the coming months, and I also expect that the inventory will move faster than it has recently. If you want to learn about what homes came on the market this past month, you can read all about them below:

February 25’ - Listing Spotlight

Last February the market really started to pick up with 14 homes listed in 2024. It seems that we are following a very similar pattern in 2025, as 15 homes officially came on the market this past February in Old Town Fort Collins. In a very similar fashion, only a handful of these homes went under contract right away, with the lower prices being most attractive to buyers as we continue to combat housing affordability due to higher prices and higher interest rates. One trend that I see each year is the feeling of lack of inventory to start the first few months. Fort Collins in general, and Old Town in particular, sees a downward trend of homes being listed in the last few months of winter leading into the holidays. This means that potential buyers might also stop their searches, and pick them back up again in the new year. While many hold the sentiment that late spring/summer is the best time to list a home (and I agree, that is a good time), I also think there is an opportunity for seller to list early in the year and capture a mixture of increasing demand at the lowest point of supply to get some tailwind into the market. I think you will see that strategy work for a few of the lower priced properties listed in February, and If you wanted to see and gain insights on what came on this past month, you can read all about it below!

January 25’ - Listing Spotlight

If I told you that a Fort Collins restaurant closed its doors in 2024 so that it could open again in 2025 would you go check out that restaurant when it re-opened? I make this point, because that is pretty much the story of the Old Town market in January of 2025. Of the 9 homes that were listed this January, only 2 had not previously been listed at some point in 2024. While some listings have had a redemption story in 2025 with offers finally coming in, others still remain the unvisited restaurant looking for customers. I’ve always felt that it is a good strategy to list a home in the first 2 quarters of the year, as buyers still look for homes throughout the holiday season, but just aren’t as committed to make a home purchase happen. 2025 is a fresh start in many ways, with much of the interest rate uncertainty seeming to just be a reality, consigning buyers to realize that an interest rate “deal” is not likely right around the corner if they just wait longer. Instead, buyers are finding ways to tap in equity, either their own or through gracious relatives to combat the affordability factor. That being said, I don’t think we have even seen the start of fresh, new inventory in the market, so I expect to see a continual climb of listings through February and into March, which will really set the tone for the spring market. Stay tuned for more as the year progresses, but in the meantime, here is an overview of what hit the market this month and my thoughts on each property.

December 24’ - Listing Spotlight

Ah yes, December. The one month that I tell seller to avoid unless it is an absolute necessity. Fact is, December is always slow in the real estate market due to the holidays. Some would say this provides an opportunity; for buyers you can get a deal with less competition, and for sellers you are the only new thing coming on the market with less competition. While both circumstances may be true, they are less likely to matter this year as the interest rate is still holding everything back. Just comparing overall numbers from 2023-2024, the amount of new homes listed in December 2024 mirrors that of the previous year, with just 6 homes coming on the market (compared to the 7 in 2023). I think we may see a higher amount of homes listed in January/February with sellers and buyers alike hoping that the spring market is helped by a decrease in interest rates (still waiting on those it seems!). Either way, a majority of these homes listed in December will remain available into the new year….where the real opportunity presents itself for buyers to snatch up a home that may not have much wrong with it besides the timing of when it was listed.

November 24’ - Listing Spotlight

As one would expect, November really start to slow down in the real estate market as we prep for the holiday season. Last year, there were 7 properties listed in November, and here in November 2024 we are right on track with that same number listed. Traditionally, homes listed in November spend more time on the market prior to receiving an offer, with a few exceptions here and there of a fast moving more unique property. That trend is holding true this year as well, with only one of the 7 homes listed under contract prior to getting into December. As has been the story all year long, housing affordability as it relates to the 30 year interest rate is holding back most properties unless they are move-in ready, or at a great value price-wise with little work to be done. The closer Old Town homes are to the overall Fort Collins median sale price, the more likely they are to receive offers, especially if they have at least 3 bedrooms. 2 bedroom and 1 bedroom homes are taking a bit longer to sell these days as they don’t provide as much long-term flexibility in the market for life changes.

October 24’ - Listing Spotlight

Comparing October of 2024 to October of 2023 will never result in a true trending comparison, primarily because October of 2023 was a record setting month as 27 homes were listed! However, this most recent October, we saw 13 homes listed which is much more in line with expectations and historic trends over the years. We truly are on the downswing of new and unique listings for the rest of the year, and with the election now behind us, perhaps some buying sentiments will open up as we are no longer waiting for the unknown? On the flip side, many may still feel that we won’t know the effects of the election until the president is sworn in come January, and given the tumultuous events of January 6th on the last go around, there may still be some “hold and wait” sentiment in the market until we get into the swing of spring. As continues to be the case, the homes listed that are either close to the median sales price in Fort Collins (Mid $500’s) or are completely move in ready are the ones that end up moving fast in the market. The rest of the homes seem to be on a trajectory of longer wait periods, with occasional price reductions. However, those price reductions don’t seem to happen nearly as quickly as they have in years past, so patience will be the key as both a buyer and seller in the current market. We will see how the next month goes, but in the meantime, if you’d like to read about all of the homes that were listed this past month, you can in my write-up of each below!

September 24’ - Listing Spotlight

September certainly felt busier in Old Town activity than in years past, and the numbers prove that point well. Last September, 11 homes were listed, but only 5 of those homes actually sold while the remainder eventually expired without an offer. This Septbember, 15 new properties were listed, with 5 of those properties already under contract and 3 more already closed in the month (non-financed offers can close quickly). There is definitely a higher demand for homes closer to the overall median sales price in Fort Collins (Which is sitting around $550K) as a majority of those homes under contract this month are right around that range in price. There is no real definitive trend of median sales price in Old Town (looking at the graph looks like a heart beat monitor) so trying to judge a market trend with month over month median sales price is pointless. I do think the we saw things open up a bit more in anticipation of interest rate reductions, which ultimately are still pretty stagnant even after the FED cut rates as expected. The reality is that the FED rate cut had been anticipated for so long leading up to the middle of September, that we actually saw the rates drop a few weeks prior to the actual cut, and then increase after the cut. Either way, rates are still down and settled into the low 6% range or even high 5% range, and a slow trickle down and stabilization into the 5% range for next spring (fingers crossed) should hopefully unlock some more inventory across the board that will get the market moving again. We will see how the next month goes, but in the meantime, if you’d like to read about all of the homes that were listed this past month, you can in my write-up of each below!

August 24’ - Listing Spotlight

August of 2024 was slightly busier in regards to amount of listings as 12 homes were listed in 2024 as compared to the 9 listed in 2023. August has traditionally been a slower month for how fast homes move, primarily as it tends to be a “transition” month in many peoples lives as summer ends, school starts, and rental cycles come to a close. That means that homes listed in August tend to take longer to go under contract until people get settled into the new normal for the rest of the year. In 2023, only 3 homes were under contract in less than 2 weeks, which is bang on the same numbers in 2024. Both years, the homes that went under contract quickly were ones in the lower price ranges (less than $700K). The largest change between the years is the amount of million dollar + homes listed in 2024 compared to 2023. In 2023 there wasn’t a single home listed over one million in August, while in 2024, four homes over a million were listed (with a few over 2 million!). While this might just be the luck of the draw, it does add more inventory and options to a price range that already has quite a few options, so that will likely equate to a longer time on market for that sector in the market. There is a sense of hope with September that rates will continue to decline creating a more affordable market for buyers and increased demand to gobble up some of the stacking up supply. We will see how the next month goes, but in the meantime, if you’d like to read about all of the homes that were listed this past month, you can in my write-up of each below!

July 24’ - Listing Spotlight

July of 2024 fell into a familiar groove of less homes being listed than the previous month. On a year to year basis, the amount of home listed was pretty flat (12 listed in July 2023 vs 13 listed in July 2024). Some of the homes listed in July of 2024 are actually homes that have already been listed earlier in the year, so there really is about 10-11 “new” properties to the market this past month. When you dig deeper into the stats, the median price of listed homes this past month was $900K…..but interestingly, none of the homes that were priced over $500K have gone under contract. Speaking with some other realtors, it seems as though the market is getting pretty flat overall on both the buyer and seller side. It is hard to tell if everything is a seasonal slowdown as summer is ending, or if buyers are just fed up with the idea of buying a home where rates make it difficult to afford. Here would be my advice: If you are a seller looking to offload a property, the more move-in ready your home is, the better chances you will get an offer, provided you price properly (nows not the time to be too proud of your home). As a buyer, opportunities are stacking up right now and it may be the best opportunity to buy as it relates to supply. Make sure you are in constant communication with your lending partner (I’ve got recommendations if you need it) as small changes in rates can make large changes in affordability. Remember, if the rates start to drop, buyers will come out of the woodworks and we may see a more competitive market again. If you are curious about the properties listed this past month of July (which I am sure you are) you can read about each property below:

June 24’ - Listing Spotlight

Despite an overall increase in overall supply of homes for sale in Fort Collins, June saw a small decrease in the amount of homes listed within Old Town with 19 homes listed this June compared to 24 homes the year prior. I wouldn’t consider the decrease in listed homes as significant in the market, but certainly the proportion of home that are actually going under contract is. In June, only 5 of the 19 homes listed had a contract by the end of the month (or early into July) which to me is a more telling sign of where the market stands right now. Yes, there is a hesitance for sellers to list their homes based on favorable interest rates that they are locked into, but the rates of the new purchasers and the relative affordability with higher rates is the real driver of a slower moving market. The median sales prices between the 2 years are tracking as very similar (mid to upper $500’s), so there hasn’t been a real change in the affordability based on pricing. Really, I see the inventory that is being made available as “not ideal” for many buyers to invest their money into, with the homes in best locations and best updates going much faster than others that still need work or having less ideal lots/locations. I think this trend will continue into the future until rates start to ratchet down over time, but I wouldn’t expect the second half of the year to look much different from the first. If you are a seller in this market, it pays to make sure your property is as show ready as possible, and if you are a buyer, there may be opportunities to wait or get credits from sellers to make your monthly payments more affordable. If you are curious about the properties listed this past month of June (which I am sure you are) you can read about each property below:.

May 24’ - Listing Spotlight

April of 2024 followed a similar trend to the previous year, and there were 15 total properties listed this April compared to the 16 listed in April 2023. With the spring market in full swing, there was definitely some more inventory for buyers to choose from this April, and there are still some of those homes available for sale. Given that March was an incredibly slow month, this positioned April to be much more active with pent up demand, 18 properties hit the market in Old Town this may, which is right inline with a year over year trend from 2023 when we saw 19 homes hit the market. This May, those properties that were listed were split between 8 condos/townhomes, and 10 single family homes. The median price for all homes listed in May of 2024 was $732,000, but in reality, there are only 5 homes that were listed that are currently under contract or closed, which is a small portion of all homes listed this month. Not to beat a dead horse here, but the affordability across the board has really been hit with lingering interest rates in the 7% range. I think there is a sentiment from many buyers (and sellers) that they will wait it out to purchase or list. Those who do choose to list in the near future need to be careful of “aspirational pricing”. Times were sweet back in 2021-2022 and most homes saw some pretty substantial appreciation during that timeframe. However, real estate operates in the “here and now” so as much as you love what an online valuation tool may have valued your home at in the past….the past may be gone, at least temporarily. The reality is that the urgency that was felt in spring/summer months of the past has long past, and it is back to the homeowner/realtor to create that urgency if you want your home to move fast. If you want to chat more details on how to create that in the Old Town market (or the market in general) give me a shout and I’m happy to chat about details! In the meantime, here is what came on the market this past month and my thoughts on each.

April 24’ - Listing Spotlight

April of 2024 followed a similar trend to the previous year, and there were 15 total properties listed this April compared to the 16 listed in April 2023. With the spring market in full swing, there was definitely some more inventory for buyers to choose from this April, and there are still some of those homes available for sale. Given that March was an incredibly slow month, this positioned April to be much more active with pent up demand, and there were a fair number of homes that delivered on the type of inventory we needed. In fact, the median of all homes listed in Old Town in April was $659,000 which is way down from the median in April 2023 of $836,500. Another thing to note, a majority of the homes listed were single family homes instead of condos, which is also helpful for providing the type of inventory that most buyers in the market are wanting. Roughly 50% of homes listed in April are either under contract or already sold, and you can read a bit more about each one below to see my thoughts on what drove those sales, and why some of the others might still be sitting. With an increasing inventory count overall (2.7 months of inventory in Old Town) we are creeping toward a more balanced level of inventory, but I suspect things won’t feel balanced overall unless the remaining inventory is closer to the overall median needed price in Fort Collins (which is currently $560K).

March 24’ - Listing Spotlight

Slow, slow, slow. That is how I would describe the listing activity this March as we only had 7 homes (4 if you don’t count homes that had been previously listed in other months) hit the market at the start of the spring season. I had to search back to 1997 to find a March that had that few listings coming to the market. I was still in high school at that time sporting a very neon yellow Borussia Dortmund Champions league jersey my parents had purchased me during a recent trip to Germany. I digress though…thats a long time ago. I think the lack of homes on the market this month will be balanced out with more listings in the following months. That provides an opportunity to sellers listing in April/May, but the reality is that the market is still slower moving overall and patience, smart pricing, and high level marketing should be employed by sellers looking to stand out in the crowd. Which of these homes do you think were best marketed for success?

Here is an overview of what hit the market this month and my thoughts on each property.

February 24’ - Listing Spotlight

The market activity is starting to pick up this year, with 14 homes were officially listed in February 2024. However, only 5 of those homes went under contract this month, and at the time of writing, there are 22 active listing to choose from, with a median price of those home at $795,000. Comparing last year, February had only 10 homes listed, with 2 of those being affordable housing/income restricted properties which skew the stats a little bit. Overall, the early market seems to be opening up some inventory options, although perhaps not the inventory that is most desirable and affordable. The median price for sold properties listed in February of 2023 was $610,000, whereas we are seeing quite a higher overall listed median price ($700,000) which doesn’t quite match the affordability factor for many people. When you did deeper into the homes listed this February that went under contract, you will see that those properties that received offers have a median price of $600,000. While numbers alone won’t tell the whole story, there are specifics to each property that drive or deter from sale. You can reach about those specifics on each property below:

January 24’ - Listing Spotlight

January saw an increase on year over year listings in Old Town with 11 properties hitting the market in 24’ as opposed to the 8 that came on in January of 23’ Of these 11 properties, only 4 were under contract or sold at the time of writing, so the demand in the market is either A) not quite there again or B) the supply of homes that hit the market are just not the right fit for the current demand. I’d lean towards option B as I analyze the current market. It seems we just haven’t seen properties that attractive to buyers both in regards to the liveability, but also the affordability. For years I’ve been saying that there isn’t a great “move-up” option for current old town residents without jumping straight into a million dollar plus home. Unfortunately, with many homeowners tied up with a low interest rate from covid times, there is a hesitancy for those low/mid-range homes to hit the market unless the sellers are forced to sell via life/job changes. That leaves a bit of a hole in the market from a supply standpoint where the supply is somewhat saturated in the $700K plus range with buyers that can’t afford what a monthly payment would be, or just slim pickings under $600K with the homes to choose from just being “OK”. Once we start to see the spring market really pick up, and get that first wave of new inventory hitting the market for 2024, I’d expect that most homes priced under $600K will go pretty quickly, and only the best of the higher priced homes will go under contract quickly. Stay tuned for more as the year progresses, but in the meantime, here is an overview of what hit the market this month and my thoughts on each property.

December 23’ - Listing Spotlight

December of 2023 showed similar characteristics in the amount of homes listed to the previous December with a total of 6 listed in 2022 and 6 listed in 2023. However, the major differentiation is that a majority of those homes listed last year went under contract in less than 2 weeks, and nearly everything listed this December is still sitting an active into the start of 2024. Of course, the interest rates, which dominated the conversation throughout the year, played a huge role in this phenomenon, but also the quality and style of product plays into the conversation as well. The homes listed this December just may not have been quite as attractive to the buying pool, not only based on associated costs, but just as a home itself. Add to that the fact that previous months of inventory (IE October and November leading into December) also had a slower churn, which provided more competition for each home being listed in the end of the year.

Here is an overview of what hit the market this month and my thoughts on each property.

November 23’ - Listing Spotlight

After a standout month of October where 26 homes were listed, I expected that November would be a much quieter month in terms of new listings. In a similar trend to last year, there were only 6 homes listed this November (5 were listed last November) which trends towards some normality in the market compared to October. I think that many sellers saw October as their “last chance” to list in 2023 before the holiday season sets in….but the recent decrease in interest rates might actually help those homes that were listed in November compared to those in October. One thing to note, there are still a few of these homes that have already been listed prior, so in regards to new and unique inventory, November really only saw 2 homes that haven’t been listed in the past 12 months….and both of those listings were Park Lane Tower condos. The slowdown in single family home listings will prove a benefit for sellers who choose to list in the beginning of the year as there has been a shortage of new and unique inventory of that type, and mixed with potentially beneficial rates and emerging spring season, it could be a great time to list and get some semblance of a competitive buyers market.

October 23’ - Listing Spotlight

September fell into a familiar pattern as has happened in years past. As would be expected, not as many homes hit the market as we cruise into the fall, with 11 homes coming to market in October was a standout month in regards to the amount of homes hitting the market. Suprisingly, there were 24 new homes to hit the market this October, which is nearly double the 14 that came on the market in October 2022! This is second in number of homes listed this year just barely behind June which had 25 homes listed. So what does this mean? Frankly, it is a bit tough to decipher why this October was such a standout month for listings, but I’m inclined to think that many realtors (myself included) would urge a seller to either listing in October (prior to the holidays coming) or wait until early next spring to list. Because the timeframe to get a home up and on the market has a small lag time (to get it done right) many of these listings that showed up in October were probably planned back in August/September and are just now hitting the market. With demand seriously hampered by high interest rates (now at the highest they have been nearing 8%) and a major influx of Old Town Supply, I’d expect that only the cream of the crop ends up with offers in the very near future, with other listings chasing the market with price reductions every 2-3 weeks to try to garner interest in their homes. Whether or not November continues to see elevated inventory is a 50/50 bet in my opinion, and I would verge towards the side that says we see a less busy November in regards to listings than normal

Here is an overview of what hit the market this month and my thoughts on each property.

September 23’ - Listing Spotlight

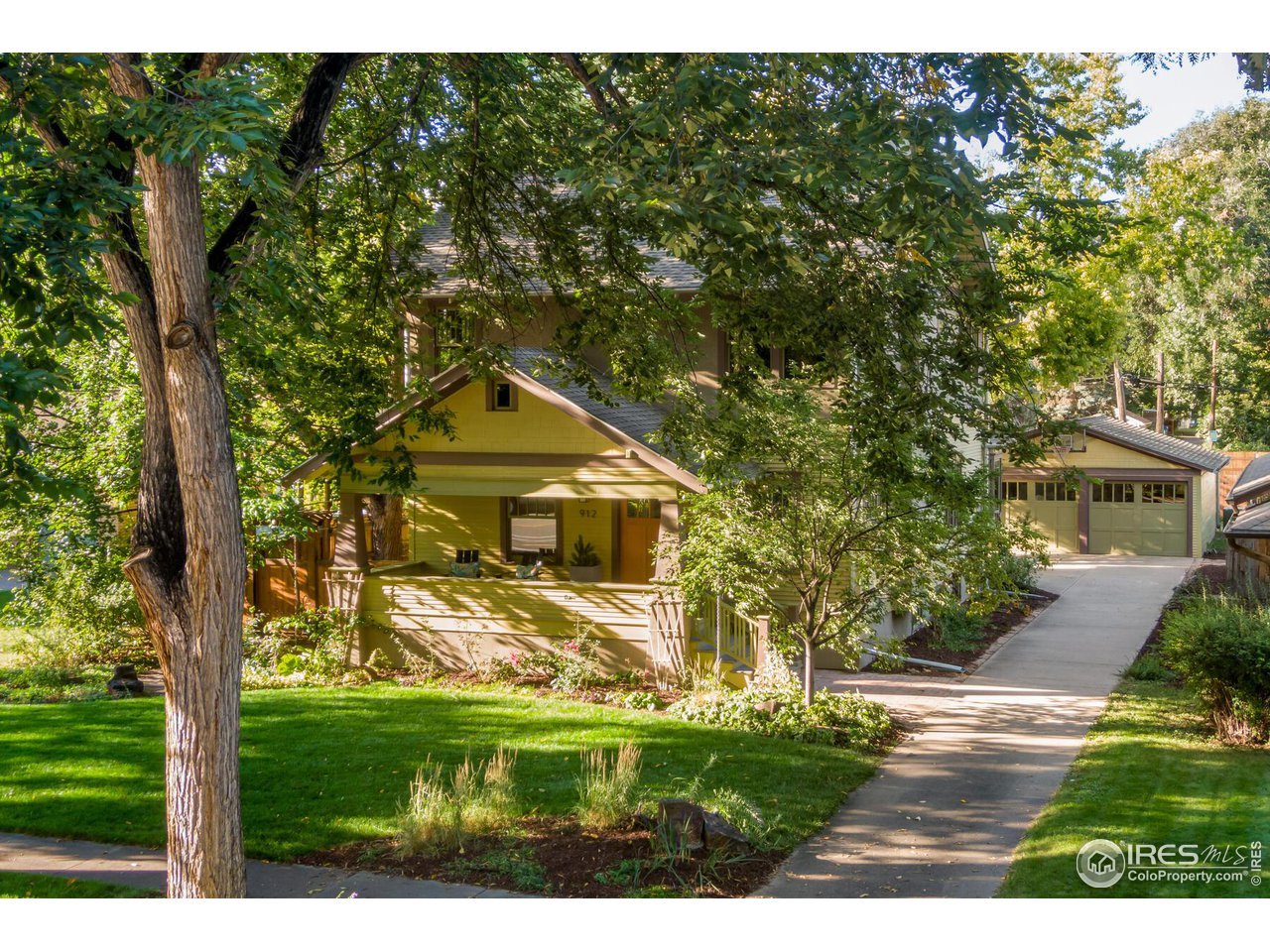

September fell into a familiar pattern as has happened in years past. As would be expected, not as many homes hit the market as we cruise into the fall, with 11 homes coming to market in September 2023 vs the 10 that were on the market in September of 2022. Within those properties that were listed in September, many are still active and sitting, following the pattern of much of the rest of the market which currently struggles due to overall affordability from higher prices mixed with high interest rates. Unfortunately, it doesn’t seem that the rate situation will go away anytime soon, so many of the currently listed homes may have to price adjust to attract the interest of potential buyers, and I wouldn’t be surprised to see many homes get withdrawn if they aren’t under contract by the end of the month. Within those that get withdrawn, the likely attitude would be relisting them in Spring, or potentially looking to rent them out, which also may be tougher to do on a fall/winter rental cycle. Really, I didn’t see many “standout” properties listed this month, with the exception of 912 W Magnolia, which attracted multiple buyers and went under contract in quick fashion. This lines up October/November for sellers to stand out if they have a property that is fully dialed in and ready to go. If you don’t know what “dialed in” looks like, lets have a conversation and I can get you lined out!

Here is an overview of what hit the market this month and my thoughts on each property.

August 23’ - Listing Spotlight

It seems that this past August really saw a slowdown in market activity across Old Town (and the market in general). In fact, the amount of homes listed in August 2023 was 9, compared to 18 listed in August of 2022….which is a pretty large swing year over year. Looking back even further to 2021 where 17 homes were listed that August, it seems evident that this particular month has been slow in the Old Town market. Within this years listed inventory, only about half of the properties are either under contract or sold, and a majority of those properties fall under $700K.

As has been the story all year long in the real estate market, higher interest rates very much be to blame for a slowdown in both listings and the speed of sales. To look comparatively, the interest rate in August of 2021 (17 homes listed) was at 2.75-3%…about as low as we’ve seen in. In August of 2022 (18 homes listed) the rates were hovering around 5-5.5%. The current rates in August 2023 (9 homes listed) was around 7-7.25%, which is about as high as rates have been in the last 2 decades. The market truly is turning into a “have to sell” market where most homes hitting the market are predicated on the sellers need to sell a home, whether for relocation, financial purposes, divorce, or other reasons. Quite frankly, most homeowners who owned through lower interest rates took advantage of those rates through refinances, and now are stuck with “golden handcuffs”….IE perhaps they would like to upgrade or change, but it is a tough pill to swallow to leave a low interest rate for a higher rate.

There has also been a heavy return to seasonality in the market that we saw pre-covid. During the last 2-3 years, the market remained heavily weighted towards the sellers as the inventory was so low and demand was so high (due to available rates), which caused a quick moving market even through the traditionally slower months of late summer into fall/winter. However, this year that “high” point in seasonality peaked earlier than normal around March/April, and we’ve seen a steady decrease in market speed and climbing inventory up until August. I do think that September/October provides an opportunity for sellers to list homes and get good activity. In months past, when there has been an overall shortage in a previous month, the inventory in the following month tends to attract higher than usual interest.

Here is an overview of what hit the market this month and my thoughts on each property.

Looking to Buy/Sell?

Lets start a conversation and see how I can help

Buy Before you Sell.

A modern solution to a long-standing problem. 8z Real Estate has you covered with our 8z Select Program.