February 23’ - Listing Spotlight

February of 2023 has continued on a “trickle” trend of homes hitting the market, with a rare occasion of more than one home hitting the home each week (in a similar pricepoint). As we review the year over year trend, this February looks more active than last February in numbers (10 listed in 2023 vs the 9 in 2022), but in reality, some of those homes that are shown as “listed in February” are actually homes that have already been exposed to the market, and then relisted in February. If we exclude those as “new” inventory to the market, we actually had 6 homes come to the market this February. Of those homes, many fell within the $500-$700K range and moved quite quickly, and the homes in the higher price points above $1.0 million are taking some more time. That makes sense given the current cost to borrow money with interest rates hovering near the 7% range at the current time of writing. I am anxious to see what March will bring as the pent up demand implicit in the spring market it starting to show is teeth again with many of the lower priced homes receiving multiple offers despite the interest rate.

January 23’ - Listing Spotlight

As we enter the new year there is lots of hope and expectation, and a fair amount of pent up demand in the upcoming market. Rates are still on the higher side of things (in the mid 6%’s) which is holding the market back a bit. the few homes that are coming on the market in Old Town and Fort Collins in general are moving pretty quickly, and I would expect this trend to continue in the market until we really start to see the inventory levels pick up.

December 22’ - Listing Spotlight

Traditionally, December is a slow month for real estate activity. That was definitely true in the Old Town market, although the market was slow overall across the board, particularly in the amount of homes being listed. In fact, there were only 42 homes listed overall in the greater Fort Collins area this past December, which is half as many as we saw across Fort Collins in December of 2021. Within Old Town, there was only 4 homes listed this past December, and each of those homes are under contract already (one already sold). I think there has been a pretty big sentiment across the board to wait to list homes for the spring market with the hope that interest rates will be in a better area for buyers, and a tailwind of traditional spring buying and selling will push the market forward. As we have trended downwards in regards to the amount of homes being listed, I think we are poised for spring listings to move quickly, but maybe without quite as much price movement as we’ve seen in the past (IE not as many multiple offers driving up price) as the cost of borrowing money is still relatively high in comparison to where it was in recent past. Either way, I’d expect that the amount of listings this January moves upwards (probably double the December numbers) as we see the spring market get under way.

November 22’ - Listing Spotlight

The holiday season is officially here, which always results in slower flow of inventory on the market. This year that flow has been turned down to a trickle as we only saw 5 new listings come online this month as compared to the 11 listings that were listed in November of 2021. Of those listings that came on, 2 went under contract in quick fashion and 3 are still available on the market. Those 2 that went under contract live at different ends of the price spectrum, with one being priced under $400K and the other being priced over $1.0 million. So what drives those to go quickly while others stay on the market? One word that I think best describes why they move fast is urgency. For the lower priced home, there is an urgency that is created in the market based on price, and more specifically, the lack of other homes on the market in similar price at the time of listing. Flat out, it had no competition for a similar size/style/price, and therefore, it moved quickly. On the $1.2 million dollar home, the urgency was created in a mixture of price and location. 1122 W Oak st is located in an incredibly sought after block of Old town between Shields and City Park. That location, mixed with a lack of inventory in that specific area over the past couple of months, certainly drove some quick interest in the home. Overall, I think we will continue to see the same factors driving sales in Old Town through December. If you have a home to sell that is either A) at the bottom of the overall price curve or B)in an incredibly attractive location you will likely still have good luck getting it under contract. However, I think a majority of sellers and buyers alike are all waiting to see what the 2023 spring market will bring, and I’m anticipating that it will likely be pretty busy again once the new year rolls around, especially as rates are starting to show a downward trend that will open up the demand again, and provide relief for sellers who would need to relocate to another home. Here are the specifics of each of those 5 homes listed:

October 22’ - Listing Spotlight

October fell into a rhythm of listings that we would expect as we transition into the fall/holiday season. Last October, 15 homes hit the market compared to the 14 homes this October (22’). However, 3 of the October 22’ homes were “recycled” listings that had previously hit the market in earlier months, so from that standpoint, we are a bit less than expected in listings when comparing year over year stats. Interest rates continue to be the major stall in the market and as of writing the rates are in the 7.25% range, which is up from last month. This, paired with the upcoming holiday season, will continue to keep new and unique listings at a slow pace as we near the end of 2022. Last month I predicted that homes would start selling for less than their listed price, and as I look over the homes that have sold since August, it does look like the market is trending this way. A majority of homes are selling at their listed values, but there are a few occasions where they are selling slightly above, and also occasions selling below. I’d expect that as long as interest rates stay this high, or climb higher, we will continue to see home values stagnate. If previous years tell us anything about what to expect in the final 2 months of the year, I’d expect that we see less than 2 dozen homes listed between now and 2023.

September 22’ - Listing Spotlight

Perhaps September is going to be the true test of buyer and seller resolve in the current market. We are now sitting with a few months on elevated interest rates (at the time of writing, the rates are hovering around 6.75-7%) which has seemed to cause a standstill in most of the market. In September of 2021, there were a total of 18 homes that came to the market, which is nearly 40% more homes than we saw come on the market this September (11 total homes). More telling than anything is the fact that many homes listed in September and sold last fall still received offers at or above list (there are a few that sold for less too), but I get the feeling that many of the homes going under contract in Old Town this September will sell for less than their listed price. Some is this is down to the quality of product, but mostly the affordability factor is really coming into play this fall. I think more concerning is the total pause seen by many across the market. Perhaps October will bring a few more homes to the market as we get through the seasonal hump, but I’d expect that November and December will be very quiet across the Old Town market as buyer and sellers alike wait for more certainty in the market that 2023 might bring.

August 22’ - Listing Spotlight

August marks a second month of elevated interest rates paired with the regular seasonal slowdown associated with the end of summer. Schools going back into session and end of summer travels almost always cause a bit of a slowdown, but this one feels more pronounced, especially in the price ranges above $500K. In regards to actual numbers of properties hitting the market, we saw 17 this August, which is the exact same number of those that came on in August 2021. However, the price spread of the homes in 2021 was between $350K-$900K, whereas this months inventory had a huge gap of homes in the $700-$999K range. As has been the case all year long the homes that have been remodeled tend to get offers most quickly, with the other subset of quick moving homes being those with “special” factors such as location, lots size, and overall value for price. I’d expect that we continue to see slow moving activity as we cruise through September, with a bit of increase as we move towards the last major flurry of homes in the fall, probably sometime in late September/October.

July 22’ - Listing Spotlight

We haven’t seen a seasonal slowdown in the market since the onset of COVID, so this July marks the first time that this slowdown has really been visible in the market for the past couple of years. Perhaps the general populous had forgotten that each year we see that seasonal slowdown in late summer (usually starting right around July 4th) as buyers, sellers, and agents alike take time to travel and enjoy the summer. This seasons slowdown just so happened to coincide with the incredibly sharp hike in interest rates that made the real estate market slam on the brakes after travelling 80 MPH down the highway for 2 years. Just like any major backup on the interstate, there are still ways to get to your destination by travelling back roads and frontage roads at slower speeds, and from what I see in the market this is becoming the new normal. What once was under contract in less than a week with multiple offers may now take a few weeks and a few price adjustments before getting an acceptable offer.

So how has the slower speeds affected the Old Town Fort Collins market? Well, the overall year to year comparison shows a few less homes hitting the market this July with 15 homes listed in July 22’ as compared t 18 homes listed in July 21’. This isn’t a huge difference, but the type of homes listed is quite different. In 2021, of those 18 homes, only 1 was listed above $1.0 million, whereas this month/year, 7 of the 15 homes listed were listed above $1.0 million. Many of these homes are taking longer to go under contract, and some are just outright over listed. The summer slowdown is definitely providing a gut check for sellers after seeing the frenzy that was the first few months of the year, but it is important to keep in mind that the equity in your home is just imaginary numbers until it is unlocked through a sale, HELOC, or refinance. These numbers, however, are well above where most people would have expected based on the year of their purchase. As buyers go, this is the first great opportunity to have some breathing room and perhaps make a deal on a property that is in benefit or your needs. Homes that have been on for more than 2 weekends are prime opportunities for deal making, so don’t be afraid to get into the market!

Here is an overview of what hit the market this month and my thoughts on each property.

June 22’ - Listing Spotlight

June has historically been the nadir of the market activity throughout Fort Collins as the summer seasonal shift occurs. Almost like clockwork, more homes hit the market in June and less buyer activity is present as households travel, renters resign leases, and many buyers close up shop for the summer to focus on other aspects of life. How quickly we have forgotten that there actually IS a season in the real estate market…we just didn’t have one for the past 2 years because the interest rate was just too attractive for buyers to not make a move! The interest rates are no longer as attractive (5.5% as opposed to 3%) and it is the speed at which this changed that has really caused the fuss in the market this year as it has exacerbated the shift we haven’t seen in over 2 years. Some will continue to call it a “downturn” while others will downplay its importance. The way I see it, markets come and go, and the market we just came out of has likely gone, but that doesn’t mean that there is no market anymore.

If we look at the Old Town year over year numbers there has been little change to the actual amount of listings year over year, with 22 homes/attached dwellings hitting the market in 2021 compared to 23 homes/attached dwellings in 2022. Last year, a little over 70% of homes listed in June were under contract in less than 2 weeks. The data is not quite there all the way this year, but about 25% of homes listed this month are currently under contract (in less than 2 weeks). I think that this is the better story to tell….not that homes are not selling, but that they are definitely taking longer to sell. The first 5 months of the year moved at such a frantic pace with buyers paying well above list price and guaranteeing appraisals, that the sudden increase of interest rate meant that only the best priced and marketed homes are getting snatched up right away. This is great news for potential buyers as you will have more time to choose between homes, and it will keep sellers and listing agents honest on their ability to correctly price properties moving forward. Expect to see the overall inventory increase around town and in Old Town, but there are still pockets of inventory, primarily the $700,000-$1,000,000 that are under-represented and may still move relatively quickly.

Here is an overview of what hit the market this month and my thoughts on each property.

May 22’ - Listing Spotlight

April continued to provide a good amount of listings to the market in Old Town. While there were not as many listings this year as last (17 compared to 22 last April) it was the quality and price of the listings that did come on the market that made April feel quite productive in regards to fulfilling demand in Old Town. Again, there is a huge inventory black hole in the $700K-$900K price range, but it was nice to see a nice collection of single family homes from $450K-$700K this month. I was also blessed with not having to write about any high rise condos being listed on Howes st., so that is always a plus in my book (I kid…but seriously, what else can I really say about them as they aren’t that different from each other?). This month did bring quite a shift in overall 30 fixed rate mortgages as we started the month with rates around 4.7% and ended the month with rates in the 5.25% range. This ever increasing interest rate is what seems to be on every buyers mind, and sellers do seem to be catching on that the “gravy train” of double digit appreciation probably won’t continue for the whole year. I think we will start to see a few more rentals get sold this year as we near the end of the rental cycle (May-July is when many renters resign leases) which will hopefully push a bit more inventory into the market (albeit, probably not that $700-$900K inventory that we really need to see shift). If you are a buyer, I’d say don’t loose hope, there will be more inventory and some will not climb as high as before. As a seller, I see the major appreciation push to be primarily done for this year, so make sure you pull back on your pricing strategy to create a bit of tension back in the market to offset the rising interest rates and affordability. Here is what hit the market this past month:

April 22’ - Listing Spotlight

April continued to provide a good amount of listings to the market in Old Town. While there were not as many listings this year as last (17 compared to 22 last April) it was the quality and price of the listings that did come on the market that made April feel quite productive in regards to fulfilling demand in Old Town. Again, there is a huge inventory black hole in the $700K-$900K price range, but it was nice to see a nice collection of single family homes from $450K-$700K this month. I was also blessed with not having to write about any high rise condos being listed on Howes st., so that is always a plus in my book (I kid…but seriously, what else can I really say about them as they aren’t that different from each other?). This month did bring quite a shift in overall 30 fixed rate mortgages as we started the month with rates around 4.7% and ended the month with rates in the 5.25% range. This ever increasing interest rate is what seems to be on every buyers mind, and sellers do seem to be catching on that the “gravy train” of double digit appreciation probably won’t continue for the whole year. I think we will start to see a few more rentals get sold this year as we near the end of the rental cycle (May-July is when many renters resign leases) which will hopefully push a bit more inventory into the market (albeit, probably not that $700-$900K inventory that we really need to see shift). If you are a buyer, I’d say don’t loose hope, there will be more inventory and some will not climb as high as before. As a seller, I see the major appreciation push to be primarily done for this year, so make sure you pull back on your pricing strategy to create a bit of tension back in the market to offset the rising interest rates and affordability. Here is what hit the market this past month:

March 22’ - Listing Spotlight

The spring market is officially in swing this year, with a total of 15 homes hitting the market this March in Old Town. That is a huge swing over what we saw last March (only 7 hit the market!) As expected, the homes that hit the market this March were under contract very quickly, meaning we will be entering April with pretty much must 1 available home (and that is just because it came on the market at the very last part of the month). There were a few standout listings this month as well, primarily in the upper price ranges as we saw the highest priced listing this year ($2.1 million on Mountain Ave) go under contract in just a few days, and another notable home on Oak st. receive some heavy activity with contracts going nearly 30% above list price! In between, there was actually quite a bit of diversity in the homes listed, but as I’ve said many times in the past year, there is a HUGE hole in the market for $700-$900K homes (there has only been 2 single family homes, and 5 total homes listed in this price range, but 2 of those were rental style duplex properties). Demand still seems strong for the moment, and only time will tell how the fast changing interest rates affect the average buyer looking to purchase in this competitive sellers market. On towards April!

February 22’ - Listing Spotlight

As I look at what has come on the market in Old Town Fort Collins in 2022, it just feels like so much less than I would have expected. However, numbers wise, there were 8 new listings this February, which is bang on what we had last February, so not really a change numerically. Digging deeper into the type of listings hitting the market really illuminates the change between this year and last. In 2021, there were 5 single family homes that arrived to the market (non duplex or investment style homes) as compared to the 1 that officially came on the market this year. While there is definitely a market for attached dwellings in Old Town, this lack of non-rental style housing remains super tight in Old Town as the new year progresses towards spring. This will continue to mean a very fast moving market into March as the demand for single family homes still remains high and the supply remains super low. It is still a bit too early to determine selling patterns until we see how much homes are selling for this year, but in Fort Collins overall the average price about list so far this year is 5% with a median above list price also at 5%

January 22’ - Listing Spotlight

A new year in Old Town real estate has begun and the biggest story on most buyers minds will be increasing interest rates. More importantly, though, should be the historic lack of inventory as we move into the new year as there is very little spillover from 2021 into the new year. As I compare what was listed in January of 2021 to January of 2022, there is actually more homes listed this year than last as there were 9 listings that hit the market in Old Town so far in 2022. In 2021, there were 10, but 3 of those were actually non-built new builds that have had a continued presence throughout all of 2021 and don’t quite react to market dynamics the same way that resale properties do. What is important to note in the first month of 2022 is that 70% of the homes listed were under contract in less than 2 weeks, showing spring-like demand right out of the gates this year. Buckle up!

December Listing Spotlight

The last month of the year has never been the most active in the real estate market, and December of 2021 mirrored that of 2020 pretty closely, with a smattering of properties coming and going from the market. In fact, there were 10 listings total this December, which is up slightly from December of 2020 when 9 hit the market. However, a few of the listing that showed up this December were properties that were under contract prior to being published, so really only 7 of these properties were subjected to the market. As I write this, only 2 are still available, which will mean a very quick start to 2022 as the first homes start to hit the market after the holidays. Here is what came on the market at the end of 2021:

November Listing Spotlight

What struck me most about November was not the total amount of homes that hit the market (10) but the overall quality of the type of homes that hit the market this past month. 70% of those listings that hit the market were single family homes, which tend to be a bit more desirable type homes in Old Town.

October Listing Recap

Old Town Fort Collins saw 18 homes officially listed in September of 2021, although a few of these have been on the market in months past and have been listed again to refresh their time on the market. The lack of single family homes, particularly in the middle to upper price ranges ($600-900K) continues to dominate the supply shortage this month.

September Listing Spotlight

Old Town Fort Collins saw 18 homes officially listed in September of 2021, although a few of these have been on the market in months past and have been listed again to refresh their time on the market. The lack of single family homes, particularly in the middle to upper price ranges ($600-900K) continues to dominate the supply shortage this month.

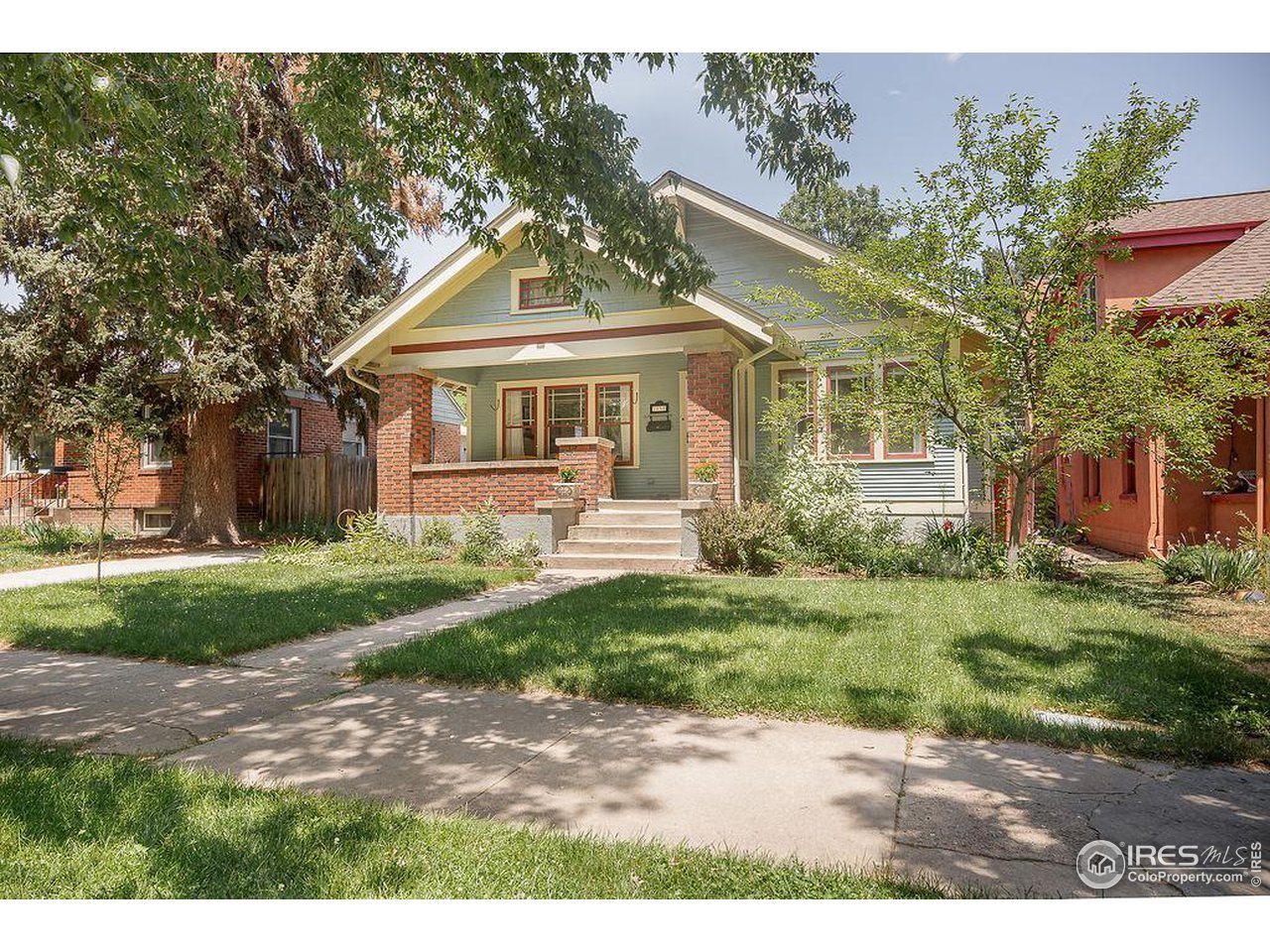

610 Laporte - Coming Soon!

Looking for a charming cottage in the heart of it all! Look no further as “the Buttercup” is officially hitting the market in the near future!

August Listing Spotlight

August brought another 17 homes to the market, but quite frankly, those numbers are a bit of a lie. 4 of those homes have already been on the market once before this year….and surprise, surprise, those 4 homes that have been on the market before are all still available (each for their own specific reasons). As for the rest of the homes, they are all going under contract quickly (every single one under 7 days, except for one home on Shields, a busy street).

Looking to Buy/Sell?

Lets start a conversation and see how I can help

Buy Before you Sell.

A modern solution to a long-standing problem. 8z Real Estate has you covered with our 8z Select Program.